How to Use Brand Building and Culture Integration to Unlock More Value from Mergers, Acquisitions and Divestitures

Brand building enables a business to unlock immediate commercial value and, even more critically, also builds longer-term value. This value becomes considerably more amplified in the context of mergers and acquisitions (M&A) and divestitures.

In difficult trading conditions, businesses are often forced to reevaluate a lot about what they offer, their value proposition and how they are structured. If an organisation doesn’t have a culture of continuous innovation or a resilient, antifragile business ethos that thrives on market stress then they’re often driven into survival mode. This typically entails re-evaluating their business model under much more extreme pressure — an urgent need to identify if it is broken or fixable with a pivot.

Related: 7 Key Branding Trends in 2020 to Grow Your Business

Naturally this leads to more M&A and with markets in flux, it can be an opportunity to build a company more smartly. Resistance is reduced and people are more open and willing to try new things. As the saying goes, don’t let a crisis go to waste.

People often talk about M&A in financial terms. In fact, key elements that make M&A value creating or value destructing are how the company uses brand building, and the power of brand culture and brand strategy. While these may be carried on the balance sheet as intangible items, in fact their business benefit and value creating potential are certainly tangible.

Related: 6 Ways to Develop and Nurture a Successful Brand Culture with a Limited Budget

Brand building and brand culture integration are sources of significant value in M&A but need to be handled the right way to unlock their full value on an ongoing basis.

Think of a marriage – even if you don’t plan on getting married any time soon, making yourself more attractive to potential partners will help you today, whether or not you have marriage on the mind. The same is true for brands.

Here we’re outlining five ways in which you can use brand building and culture integration to improve your business returns in an M&A environment where clients are running the slide rule over what you offer — whether or not M&A or divestiture is in your mind right now.

In real terms you should have your house in order so you can readily make decisions to buy or even sell your business or brand. This factor has proven repeatedly to be some of the key reasons why clients have chosen to completely re-evaluate and develop their brand strategy. The outcomes have enabled them to build much more resilient and future proofed businesses.

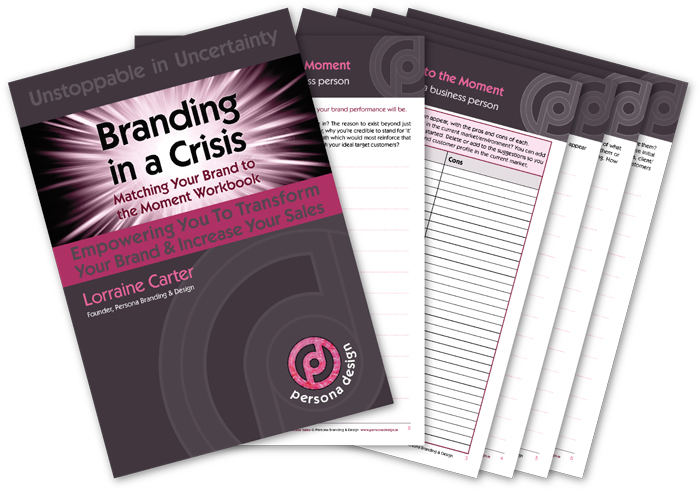

Related: Branding in a Crisis, 5 Practical Steps so You Match to the Moment Brilliantly

We know that sometimes it’s a struggle to build a brand strategy that really engages your ideal customers effectively so we’ve developed three different ways of working with us to help you build your brand, depending on your preferences, so if you’d like us to:

- Build your brand for you – find out more here or get in touch [email protected] or ring +353 1 8322724

- Empower you to build your brand – check out the Persona 7-Figure Business Building & Brand Strategy Mastermind here. This is a 12 week face-to-face, fully interactive, live online programme for non-competing peer groups. You work on your brand with us codifying and mapping out your brand strategy for business growth. Within 12 weeks your brand strategy is fully developed, with implementation already making a difference in your business. Alternatively, join our half-day Branding Accelerator Masterclass for a fast-injection of brand building essentials. Ask about our Personal and Corporate Leadership Brand Alignment Masterclass

- Want a DIY solution? check out our how to build a brand eprogramme here and our how to audit your brand yourself eprogramme here

5 Ways to Use Brand Building and Culture Integration to Maximise ROI in an M&A Environment

1. Mergers Emphasise Brand Building Power

Sometimes a merger is a way to leverage benefits from brands, by expanding their reach or using them in conjunction with the merged brand to bring the benefits associated with both brands into one customer facing brand positioning.

For example, musician Kanye’s West’s “Yeezy” range for Nike followed by Adidas combines the power of West’s star status with the credibility and reach of Adidas as a sportswear company. Both brands offer a different but vital part of the overall brand proposition.

M&A is often driven by the attraction of acquiring something from another company, whether it is factories, top people talent, intellectual property or some other valuable asset set. Brand assets can be one of the most valuable things acquired in M&A. They can help a supplier of a product or service build up a more credible portfolio across different price points. Building a brand successfully can take time, whereas buying in a brand which is already well established in its target markets can be done very fast.

In largely unbranded or labour intensive businesses such as the building trades or security companies, the offerings can often seem fairly undifferentiated and generic to customers except on price. That can feed a race to the bottom between companies when it comes to pricing — the cheaper you are, the more likely you may be to win the work.

Strong brands move target customers’ perceptions about your offering away from basic denominators like price, to a more rounded view of what sets your organisation apart. Mergers allow pricing premiums to be achieved by using the power of brand building, for example security company G4S has long been acquisitive of local security companies, which under its established brand will likely be seen in a more premium light.

Image via The Guardian

A product case study is provided by the book chain Waterstone’s. At a time when high street bookshops were struggling in business, they acquired the niche travel retailer Daunt, which had made a success of reinventing its bookshop offering. With this acquisition, the much larger Waterstone’s chain also brought in a fresher, more innovative brand culture from Daunt then adopted across Waterstone’s, indeed they even gave the chief executive of Daunt the same remit for the much larger chain.

Related: Redefining Your Brand Culture After a Rebrand, Sale or Merger

2. Acquisitions Enable Companies to Buy In Brand Building Rather than Do It Themselves

Brand building is an important way for an organisation to build value, through identifying its key brand assets, adopting a distinctive tone of voice, communicating strategically in line with its brand architecture and other activities which help elevate the way it is thought about by its target customers.

However, scale and company culture can make it difficult for large organisations to build brands from scratch. Smaller, more nimble companies typically have more flexibility and permission to iterate their brand quickly to get it pitch perfect. Sometimes, therefore, larger companies prefer to let startups or SMEs build the brand and buy them once they have a proven success model. This is a win-win: scale and reach for the brand owners, lower risk growth strategy for the acquirer.

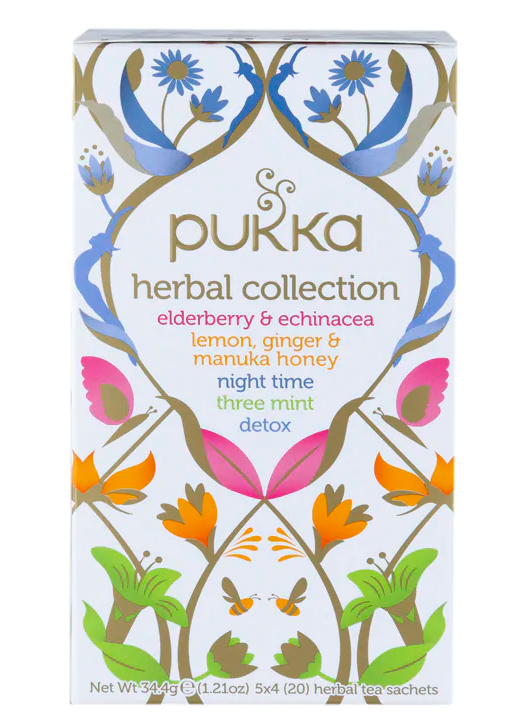

Image via Holland & Barrett © Pukka

A B2C product case study is the disruptor brand Pukka Tea, which was acquired by consumer goods behemoth Unilever. Unilever already had well-established mainstream tea brands, such as PG Tips and Lipton. There was a gap in its product portfolio for a funkier, more contemporary feeling tea brand. Instead of trying to build one from scratch, it was able to get one fully formed by acquiring Pukka – which in turn benefited from the global reach of Unilever.

Related: Brand Disruption, Be the Disruptor or Be Defeated

Are you a business leader, manager or entrepreneur who wants to re-evaluate or build your brand strategy so you can unlock the power of brand building and brand culture in M&A and divestitures to increase your sales?

Are you curious about how to build or scale a highly successful standout brand? Join one of our branding masterclasses because they empower you to build your brand, enhance customer experience, expand your market impact and create higher perceived value so you can command a premium.

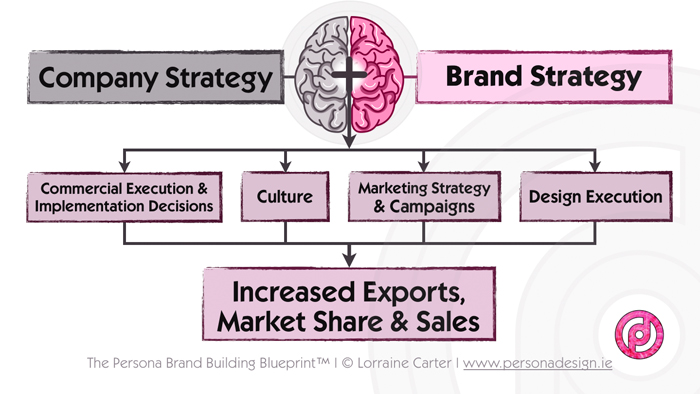

In fact, the Persona Brand Building Blueprint™ Mastermind is all about fast-tracking you, your brand and your business through the brand building, agile branding strategy process using professional big-brand know-how with proven systems that get results so you can grow your business faster and more effectively.

The programme enables you to make your brand highly visible, different, credible, trustworthy, memorable and much loved amongst your ideal customers so you can become more profitable and leave your competitors way behind. Be The One — your ideal customers’ favourite brand of preferred choice commanding a premium.

If you want a tailor-made solution specifically for your brand then we also provide inhouse bespoke Persona Brand Building Blueprint™ Intensives working with you and your team so you can grow your business faster and more profitably. Contact us to discover more [email protected] or +353 1 8322724

3. Brand Building Helps Scale Up Little Gems in M&A [Mergers & Acquisitions]

Sometimes in acquisitions, a number of brands change hands. In large acquisitions, the acquirer sometimes even acquires small or market-specific brands without even knowing it in advance, as part of a larger purchase. The new owner may look at them with fresh eyes – often a seller is willing to divest brands because they are unloved or lack the right focus or resources, so it’s common that this happens.

Having a structured approach to brand strategy enables you to assess whether brands acquired could be reinvigorated or more strongly resourced and turned into something much bigger — a significant profit powerhouse.

Image via Amazon © Olay

Consider as a case study the old-established pharmaceutical company Richardson-Vicks, most famous for its eponymous Vicks brand. Pantene was a small, niche, salon brand when P&G bought the Vicks owner, which happened to have Pantene in its portfolio also. Similarly, the company had a small skincare product in Mediterranean markets called Oil of Olaz.

After integrating the Vicks brand, P&G started to assess what it might do with these other little gems of brands it had acquired in the same deal. By revisiting their brand strategies, P&G managed to build Pantene into a successful mainstream hair care brand with unique reasons to believe and Olay into a global skincare power brand.

Related: Brand Building, 15 Short Term Ways to Build Your Brand for the Long Term

4. Divestiture Enables Brand Building to Give Brands More Space to Shine

Bigger isn’t always better – a lot of brands are better managed by a smaller, focussed team than in large organisations.

Some brands do better in the hands of an SME or solo entrepreneurs than large companies. On their own they have space to grow, more accountability and more focus. This can vary according to the point a brand is in its lifecycle.

As brands grow and try to scale up, it can sometimes be helpful to be part of a larger home than at the beginning of the brand’s lifecycle. But later on, when a brand is large and almost taken for granted, or pushed aside for newer brands in its company, it can be useful for it to be released into the loving hands of a small, focussed team.

Image via Construction Enquirer

A relevant case study is Ibstock Bricks, Britain’s leading manufacturer of bricks for the building trade. Formerly it was owned by construction behemoth CRG, within which it was never going to be able to assert its own brand identity clearly. After being spun out in a management buyout, Ibstock Brick was able to focus on its own brand identity and its unique clay brick expertise more than it has been under the ownership of a generalised construction material group.

Image via Irish Mirror © Abran

Another case study in the B2B arena is Abtran, Ireland’s leading provider of business process management services for utilities companies. Founded in Cork in 1997 with six employees, it now has over two thousand. It has changed ownership several times. It ended up at one stage as part of a larger investment vehicle, a common situation but one where a brand’s needs and uniqueness can struggle to be heard amidst competing calls on management time and an emphasis on operational efficiencies. A management buyout divested the brand into a standalone company, allowing the focus on the brand.

Related: Agile Branding and Top 6 Lessons from Fintech

If you’d like to discover more about building and maintaining a thriving, high performing, highly profitable standout brand, then get in touch because we’d love to help you make your brand into a profit powerhouse.

- Schedule a chat — we can meet in person online

- Let’s consider a customised plan for you

- And perhaps implement the plan together

- Contact us [email protected] or ring +353 1 8322724 (GMT Dublin/London time 9:00 – 17:30 weekdays)

Lorraine Carter is a branding expert and international speaker delivering talks, online and offline, that inspire and motivate.

Her experiential masterclasses and workshops online inform and support transformational outcomes fast.

Discover more about the Persona Branding and Design team and their consultancy expertise that solves your problems — using agile branding strategy underpinned by professional big-brand know-how — so you can outshine, outperform and leave your competitors way behind.

Our purpose is to enable you to Be The One — your ideal customers’ favourite brand — commanding a premium with 7-figure growth.

Ask about the Persona 7-Figure Business Building and Brand Strategy Mastermind — live, interactively, face-to-face online.

5. Brand Culture Integration Unlocks More Brand Building Value From M&A [Mergers and Acquisitions]

Having a guest in a big house can be a breath of fresh air and change the way the whole household thinks about things. It can also be a terrible experience! It’s the same with brand cultures – in a positive situation, acquiring a brand with a good brand culture can imbue the wider organisation with some of the benefits of that brand culture. This is good for staff morale and talent retention as well as business performance.

That is why large professional service firms often acquire smaller, funkier feeling SMEs and then use them to bring a fresher, more innovative culture to the mothership. As a large company often has structure, systems and opportunities which are scarcer in smaller firms, such a deal can be beneficial for staff and company in both directions.

Image via AIthority © Accenture

A case study is the acquisition of boutique insights agency Happen by multinational consulting group Accenture. The distinctive tone of voice, outlook and skillset of Happen was liked by clients, and was something a large firm such as Accenture would struggle to build from scratch. But equally, seeing their brand culture take root within Accenture was likely encouraging for Happen staff.

Related: The Impact of Company Brand Culture On Driving Performance and Increasing Sales

Final Thoughts

During a crisis, some of your assets reveal their true value if you approach them the right way. Brand is one such asset. Brand building and brand culture can help your business results today, but it also enables you thrive through market turbulence with both business and brand resilience.

Whether you are eyeing M&A, a divestiture, or are thinking about ways to get some external funding into your business, brand building and brand culture have a crucial role to play. They help businesses get the right mixture of elements, and scale up to the optimal size and organisational structure. So the question is, are your brand and brand culture ready today to play their role?

Questions to Consider

- What is your brand’s biggest asset?

- How does your brand make your organisation more attractive to the outside world?

- How would you reinvigorate a neglected brand in your industry?

- What are you and your organisation currently doing to nurture your brands?

- What are the most attractive factors about your brand culture? Why?

- Do you need to re-evaluate your brand, business model and brand strategy using a brand audit so you can leverage their true value or get your business on a more solid footing, pivot, adapt your business model — build in the essential resilient factors to thrive in adversity?

Your Persona Client Satisfaction Guarantee

- When you work with us we’ll create a customised brand building plan and strategy with clear investment for you tailored to your specific requirements and preferences

- You’ll know each step of your brand building journey before we start because we’ll discuss it, document it and agree on it with you before work commences

- You’ll have timelines, key milestones and deliverables to evaluate and approve for each stage and part of your brand building process

- Because we know the unexpected sometimes happens we can make adjustments along the way if you need it and if something extra is requested we’ll ensure you’re fully appraised about what that entails before committing

- As we achieve pre-agreed objectives you’ll be able to evaluate your brand building work and strategy in progress, coupled with the outcomes to ensure return on investment

Get in touch today because we’d love to enable you to re-evaluate and build your standout, powerhouse brand so you can Be The One — increase your profits and leave your competitors way behind.

Email us [email protected] or ring us +35318322724 (GMT 9:00-17:30) and ask about our VIP Brand Strategy Re-Evaluation.

“We participated in the Persona 7-Figure Business Building & Brand Strategy Mastermind 12 week online course. The 12 week program suited us as the weekly accountability spurred us on to get work done between sessions.

“We participated in the Persona 7-Figure Business Building & Brand Strategy Mastermind 12 week online course. The 12 week program suited us as the weekly accountability spurred us on to get work done between sessions. “For anyone who has a well established business I would totally recommend working with Persona Design because it will provide them with a new perspective on how to think of their brand. You see in different markets and industries that are overly competitive

“For anyone who has a well established business I would totally recommend working with Persona Design because it will provide them with a new perspective on how to think of their brand. You see in different markets and industries that are overly competitive  “Lorraine Carter has been the catalyst and an inspiration for MGI Learning to clearly define our brand.

“Lorraine Carter has been the catalyst and an inspiration for MGI Learning to clearly define our brand.