Agile Branding and 6 Top Lessons from Fintech

‘Agile’ is an iterative and incremental build process in software development which started to emerge in the 1970s and has gathered greater momentum and application over recent years – noticeably in fintech. Agile branding strategy is all about making better informed, smarter decisions faster so teams are empowered to identify, solve problems and communicate effectively with the greatest impact. It doesn’t mean hasty or slapdash either just because it’s a lean approach but it does mean taking some faster-calculated risks to reduce higher more exposed risks.

We’re sharing with you some of the insights from successful agile branding so you can apply these strategies in your branding because they can be highly effective applied outside of fintech too.

Originating in computer programming and digital projects, this lean approach to development is now being adopted in other areas of research, development and innovation in business.

Indeed, brand strategy, marketing and design as three separate disciplines are embracing an agile approach, with companies of all sizes evaluating how it can be applied to improve their return on investment faster, whilst also significantly cutting development costs and launch to market timelines.

It’s important to remember branding strategy is the bedrock underpinning your whole business. It provides the direction for marketing and design so it must come first before either of these other essential disciplines are engaged.

Related: Design Is NOT Branding, 10 Things Every Business Owner and Entrepreneur Should Know

Most importantly agile branding strategy enables businesses to be far more responsive to customer feedback and cut projects with less long-term viability before they become too advanced.

Key factors include:

- Building out your brand strategy with intensive team focus condensed over a number of days — in our case typically two days with the Persona Brand Building Blueprint™ Intensive. This agile approach is our preferred mindset instead of the more common status quo entailing weeks or months because it empowers business leaders and entrepreneurs to get very focussed with much faster implementation and outcomes

- Pragmatism and nimble flexibility is an important cultural mindset because too much perfectionism means you’re not engaging responsive market feedback iteratively to inform faster development. A successful business is driven by strong commercial imperatives so these have to be balanced against too much refinement at the expense of getting informed feedback. This could also be called a ‘beta branding’ mindset because branding is never ‘done’ or finished. It’s an ongoing journey to develop, establish and maintain relevance. There’s also the constant disruptive competitor threat because the market moves so fast. Agile branding strategy reduces your exposure so you are the disrupter not the disrupted

- Agile branding strategy also requires collaborative thinking and a willingness to change or pivot because successful outcomes are rarely delivered fast with isolated, protectionist or siloed mindsets. This means open, co-creation with different skills, perspectives and shared departmental expertise because this kind of mindset is essential for success. It underpins innovation and creative thinking — all of which enables businesses to succeed in a highly competitive market place

Here we look at how agile brand strategy, marketing and design thinking is being used in fintech. Fintech has been an early adopter of agile principles in adopting and building its disruptive alternative, relative to traditional financial services providers. We’re also drawing on some takeaways from agile in fintech because the lessons learned can be applied across businesses in multiple other sectors, B2B and B2C, SME/SMB and enterprise.

Get our complimentary ‘Tech Branding’ Worksheet because it empowers you to unlock the systems and processes used to build stand out brands with big brand know-how.

It contains tools, checklists, references and insights from over 20 years award-winning branding expertise to help lead you through the process of successfully building your Tech Brand so you can increase your profits.

1. Speed is a Business Differentiator in Fintech and Agile Branding

Agile is all about getting new initiatives to market faster. Quicker, iterative development with early user feedback can help reduce costs but most importantly it enables businesses to get first mover advantage.

In other words, by appearing in the marketplace before competitors they can capture their ideal customers’ imagination and cultivate a head start in building brand loyalty with a customer-centric focus. It may not be perfectly developed or fully refined, but invaluable market feedback informs key decisions in development and provides direction if pivoting is required.

Related: Brand Disruption as a Business Framework for Future Growth

This is also true for brand strategy, marketing and design in all its various disciplines. Being in a position to identify and respond to feedback fast enables fast iteration. In a digital context, this translates into reduced waste and less costs and more effective research, development, brand strategy, marketing and design.

The momentum created in this approach can also help solve one perpetual new product development challenge, that of converting great ideas into action across brand strategy, marketing and design. When a company adopts an agile branding approach, that typical ‘idea into action’ challenge which plagues many upstream branding projects can become a thing of the past.

Image via TalkAndroid

An example of this speed as a competitive advantage is demonstrated by the popular payment device and app Square. The brand emphasizes its speed, enabled by its digital infrastructure, over traditional payment service providers. This branding can be seen in this video.

One interesting thing about Square is that unlike many technology brands especially digital brands, it has been able to build its brand identity in the offline world successfully through its usage device being a square, neatly reminding consumers of the brand at the point of use thus helping build brand loyalty.

Related: How Apple Does It, Five Tips for Getting Your $1Tn Brand Personality Right

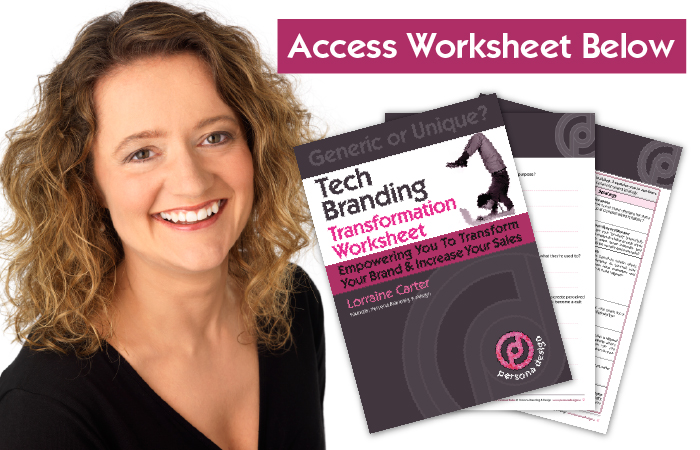

This holds true for B2B as well as B2C. For example, U.K. based mobile payments company Sumup enables merchants to process card payments wherever they are located.

So for example, it can work for a mobile food company but also for a professional like a tradesman whose business clients wish to pay by card onsite. The product gets glowing reviews, yet Sumup was able to launch in several dozen countries in just a few years. Compare this to the slow pace of traditional financial services expansion which involves significant compliance efforts.

Image via ©Sumup

We know that sometimes it’s a struggle to build a brand strategy that really engages your ideal customers effectively so we’ve developed three different ways of working with us to help you build your brand, depending on your preferences, so if you’d like us to:

- Build your brand for you – find out more here or get in touch [email protected] or ring +353 1 8322724

- Empower you to build your brand – check out the Persona Brand Building Blueprint™ Mastermind here. This is a two-day intensive where you work on your brand with us codifying and mapping out your brand strategy for business growth fast. We also develop bespoke solutions specifically for in-house teams. Alternatively, join our half-day Branding Accelerator Masterclass for a fast-injection of brand building essentials. Ask about our Personal and Corporate Leadership Brand Alignment Masterclass

- Want a DIY solution? check out our how to build a brand eprogramme here and our how to audit your brand yourself eprogramme here

2. Agile Branding Gives Customers Relevant Fintech Solutions

The more appealing a proposition is for a customer the more likely they are to do business with you. Many brands broadcast a lot of noise to the market and achieve little in the way of meaningful commercial results. The ability to deliver a tailored message that gets results to the right target audience — your ideal customers — sets you apart from this crowd so making it far more likely that those recipients will engage with your marketing campaign.

Digital enables mass customization to make propositions specifically appealing to segmented customer types — your Purchaser Personas. The rapid iteration of an agile branding approach improves appeal, because decisions are quickly made based on what’s worked in the earlier iterations.

Related: Listen Up: 7 Ways To Amplify Brand Power Using Sound With An Audio Logo

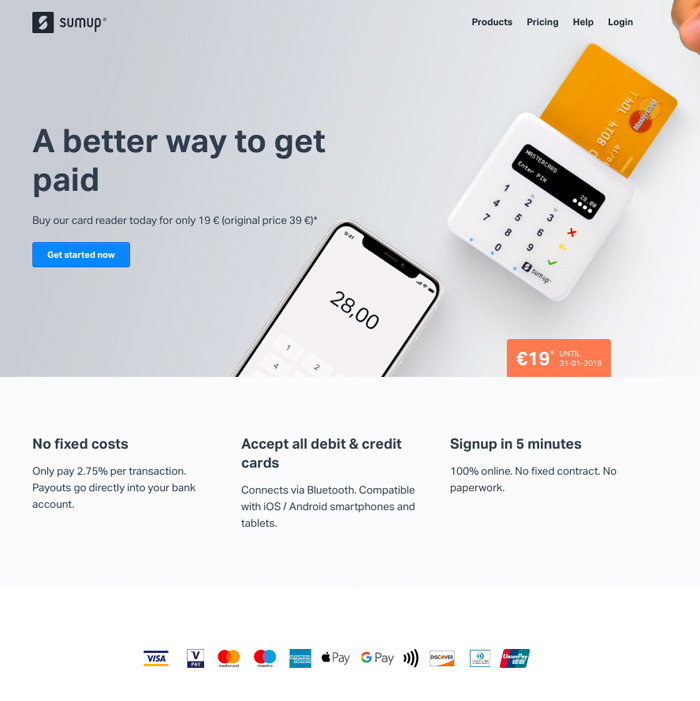

A case in point is Tandem Bank. Many banks lack strong stand out differentiation or a brand personality which appeals to their customers – a point underlined by DBS Bank’s current campaign touting less time spent banking.

Image via ©DBS Bank

Related: Personality Matters, Bringing Your Brand to Life to Grow Profits

Tandem Bank has a mobile app which enables it to offer money saving opportunities to its customers which reflect their specific financial circumstances and objectives.

Image via ©Tandem

You can listen to more about that approach in this podcast.

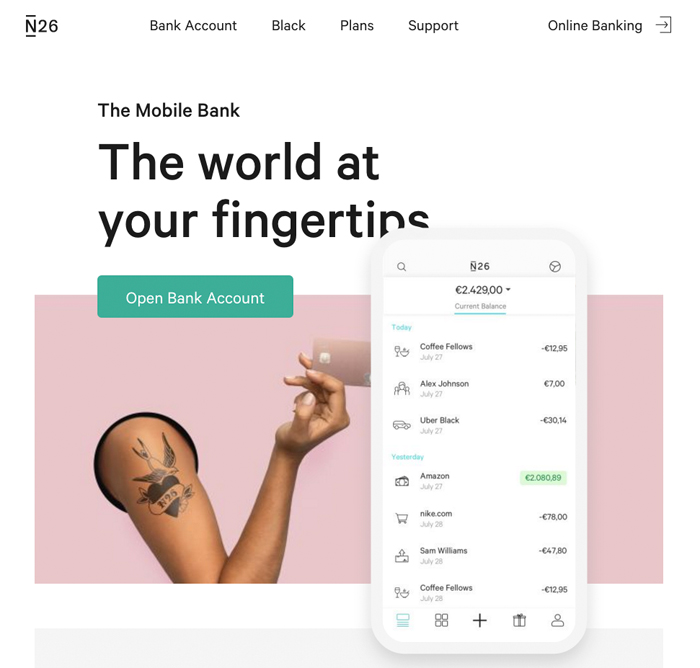

Similarly, in Germany, the digital-only N26 Bank is another challenger brand which makes a virtue of its digital nature, telling potential customers that it is ‘as mobile as (they) are’. You can see its proposition and brand positioning spelt out here.

Image via ©N26

Related: Digital Brand Identity Essentials – How to Build, Resonate and Grow

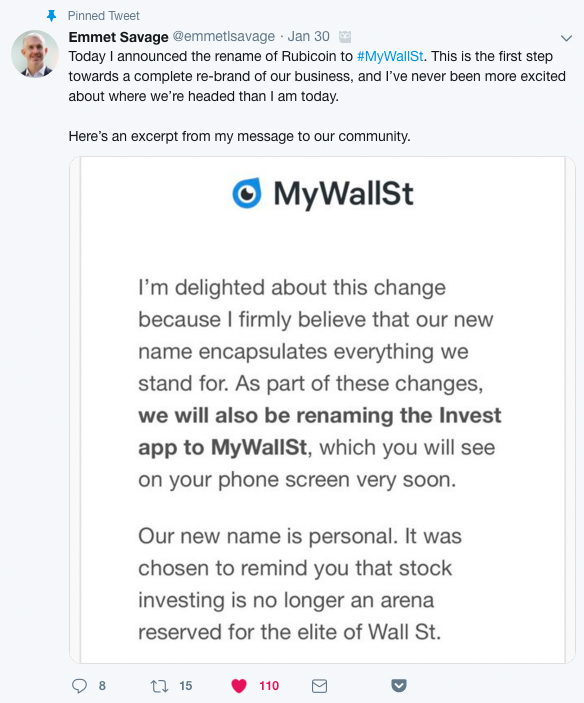

The Irish investing brand MyWallSt. (previously named Rubicoin) has done a great job in this regard. MyWallSt. is one of Ireland’s fastest growing fintech companies. It has a distinctive brand tone of voice about being on its customers’ side, which is clearly evident in their blog explanation of the role of the customer in their offering.

Related: How to Develop Your Brand Tone of Voice to Increase Sales

The MyWallSt. brand is explained through this video.

The enthusiasm around MyWallSt. (previously known as Rubicoin) comes through in the user review in this video.

Related: 4 Ways You Can Be More Customer-Centric to Grow Your Business

3. Agile Branding in Fintech Makes Smart Use of Big Data to Improve ROI

Big data is talked about a lot but it is often not well understood in branding strategy or marketing teams. The challenge is not the data – even small businesses can easily amass large datasets about their customers – but what to do with it.

Agile methodologies use big data to inform decision making and improve outcomes. This can help brand strategy, marketing and design in terms of targeting the right customer, maximizing the lifetime value of customers and identifying the most cost-effective channels and messages to attract and retain business.

Related: Increase Sales Using Buyer Personas, Your Guide to Understanding and Targeting Your Ideal Customers

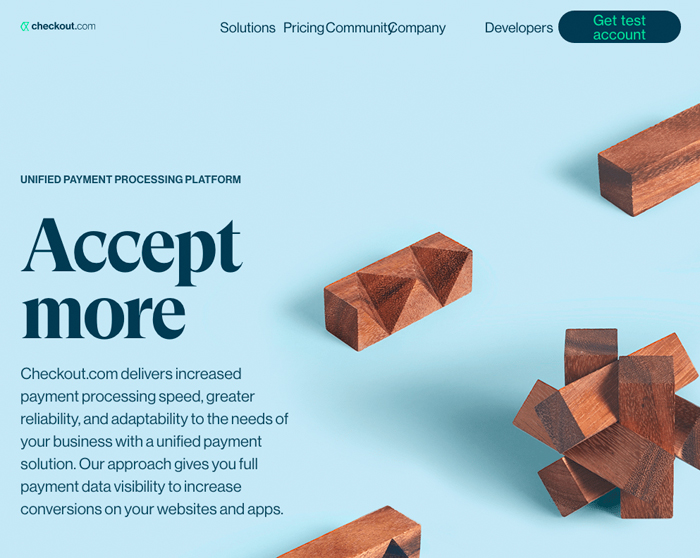

Image via ©Checkout

A case study here is the London-based fintech startup checkout.com. Checkout.com provides a single payment system built in-house. It has seen large growth, and numbers almost three hundred employees – yet in 2017 it spent only 117,000 pounds on marketing. It was able to do that because its massive tech team worked hard to optimize their business model based on their customer data. This is evident in this video.

Related: How to Build a Brand Like Amazon, Technology Branding and Marketing

Are you a business leader, manager or entrepreneur who wants to re-evaluate or build your brand strategy so you can effectively leverage agile branding trends to increase your sales? Are you curious about how to build or scale a highly successful standout brand? Join one of our branding workshops because they empower you to build your brand, enhance customer experience, expand your market impact and create higher perceived value so you can command a premium.

In fact, the Persona Brand Building Blueprint™ Mastermind is all about fast-tracking you, your brand and your business through the brand building, brand strategy process using big-brand know-how with proven systems that get results so you can grow your business faster and more effectively.

If you want a tailor-made solution specifically for your brand then we also provide in-house bespoke Persona Brand Building Blueprint™ Intensives working with you and your team so you can grow your business faster and more profitably. Contact us to discover more [email protected] or +353 1 8322724

4. Quick Testing in Agile Fintech with Agile Branding

One of the critical elements in agile is learning fast through testing then amending. So instead of trying to perfect something before bringing it to market, agile focusses on getting something out fast and then getting reaction fast from early adopters or test users.

This principle has long been used by some brand strategists, marketers, and designers for example with rapid prototyping or sending test emails out to different groups to identify which version elicits the highest response rate. Agile marketing guru Gary Vee explains the process well in the Q&A in this video.

5. Agile Branding in Fintech Benefits from Iteration

There are several benefits of testing with a small number of users. One is that this is cheaper than going all out with a full campaign. But more importantly in an agile context, it enables you to iterate what you are doing, based on the user feedback you receive during the testing phase.

This applies not only to technology but also to any sort of branding, marketing or design activity. If you can get a ‘thin slice’ of feedback early enough, you can make changes on the fly which will allow you to maximize the effectiveness of and financial return from your branding strategy and marketing budgets.

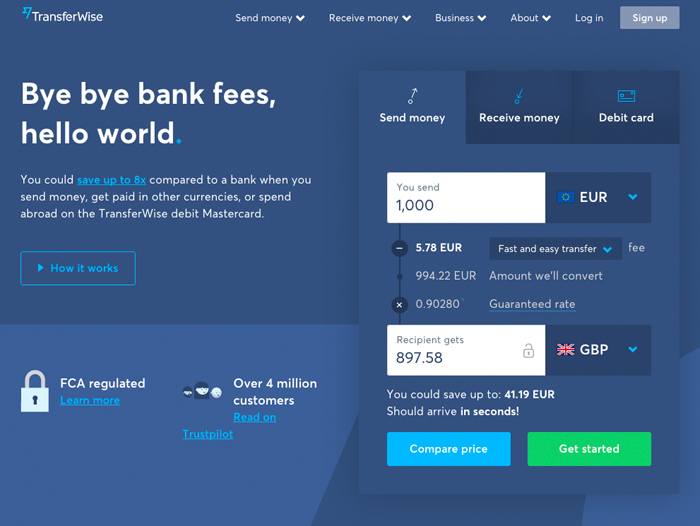

Image via ©Transferwise

An interesting real-life example is the company Transferwise. Transferwise zoomed in fast on the key features which a fintech audience wanted to have communicated to them, by iterative testing. You can learn more in this video.

6. Getting the Right Mix of People in Agile Branding Teams

One of the key elements of an agile methodology is its use of cross-functional teams. This can be challenging for brand strategists and marketers because many like to protect their territory and exert control over what they do. This siloed mindset results in important input from functions such as sales or finance being overlooked or entirely neglected.

Related: What Game Of Thrones Can Teach Us About Brand Story

An example is provided by the construction consultancy Arcadis, which runs design sprints known as ‘Deep Orange’. These operate as a way to engage multiple stakeholders in urgent local problems. The Arcadis Deep Orange approach is summarized in this video.

Related: How Leaders Drive Profitability With a Strong Brand Vision Statement

If you’d like to discover more about building and maintaining a thriving, high performing, highly profitable standout brand, then get in touch because we’d love to help you make your brand into a profit powerhouse.

- Schedule an appointment — we can meet in person or online

- Allow us to create a customised plan for you

- Let’s implement the plan together

- Contact us [email protected] or ring +353 1 8322724 (GMT Dublin/London time 9:00 – 17:30 weekdays)

Lorraine Carter is a professional speaker delivering talks that inspire and motivate along with masterclasses and workshops that inform and support transformational outcomes fast, and consultancy solutions that solve problems so you can outshine, outperform and leave your competitors way behind.

Final Thoughts

There is a lot of media discussion about how fintech is using agile methodologies to build success stories fast. The good news is that a lot of agile methodologies can be used for agile branding, marketing and design, whether or not you are in fintech.

The basic principles and insights we’ve shared include things which can be replicated across a multitude of B2B and B2C environments. Do things fast, test and learn, focus on doing more of what works and get the right mix of people involved within your organization to help drive your business initiatives forward. With just a few simple steps, your business could reap the rewards of an agile mindset starting today!

Questions to Consider

- Is your current business speed a competitive advantage or disadvantage?

- Could you make your offering more relevant to your ideal target customers using an agile branding strategy, starting now?

- Do you have the tools to measure your branding ROI? How could you improve it?

- Are there cost-effective ways to test and build your branding activities and marketing campaigns before you launch in full to the market?

- Does your team combine the right blend of people from different functions and perspectives?

- Would your brand benefit from a brand audit health check so you can evaluate your strengths, weaknesses and opportunities for innovation and growth?

- Do you need to consider a brand revitalisation, refresh in your brand strategy or review of your positioning so you can leverage agile branding to the full?

Your Persona Client Satisfaction Guarantee

- When you work with us we’ll create a customised brand building plan and strategy with clear investment for you tailored to your specific requirements and preferences

- You’ll know each step of your brand building journey before we start because we’ll discuss it, document it and agree on it with you before work commences

- You’ll have timelines, key milestones and deliverables to evaluate and approve for each stage and part of your brand building process

- Because we know the unexpected sometimes happens we can make adjustments along the way if you need it and if something extra is requested we’ll ensure you’re fully appraised about what that entails before committing

- As we achieve pre-agreed objectives you’ll be able to evaluate your brand building work and strategy in progress, coupled with the outcomes to ensure return on investment

Get in touch today because we’d love to get started helping you build your standout, powerhouse brand so you can increase your profits and leave your competitors way behind.

Email us [email protected] or ring us +35318322724 (GMT 9:00-17:30) and ask about our VIP Brand Strategy Discovery.